Dr. Wayne Brown

Founder

History

Kinect Capital was originally created in 1983 as the Technology Innovation Center, an educational 501(c)(3) non-profit. It was founded by Dr. Wayne Brown, a legendary serial entrepreneur and a professor at the University of Utah. As a leading authority in technological innovation, commercialization, and entrepreneurship, Dr. Brown saw the need to educate founders in the art and science of building successful startups. In 1983-84, we created the world’s first venture accelerator, and our non-profit volunteer model is still unique. Brad Bertoch was brought in as CEO in 1985, where he served until he retired in 2019.

Dr. Brown had served as former Dean of the College of Engineering, as well as teaching in the business school at the University of Utah. He was a founder of multiple investor-backed companies, including Kenway Engineering (HK Systems), TerraTek (Schlumberger), and Native Plants (Agridyne Technologies). Additionally, Dr. Brown also served as co-architect with Roland Tibbitts of the U.S. Small Business Innovation Research (SBIR) program.

Dr. Brown led Utah’s State Science Council where he spearheaded legislation to create the Utah Technology Finance Corporation (now Innoventures) and Utah’s Centers of Excellence program (now TCIP), while also successfully negotiating with the U.S. government to obtain military land for the establishment of the University of Utah’s Research Park.

Kinect Capital Board members created Utah Ventures (now Pelion Partners, Utah’s first venture fund), SLC Angels, Salt Lake Life Science Angels, and Park City Angels, one of the most active angel groups in the country. They were also integral in the creation of Zions Bank’s venture debt program, the Salt Lake County venture debt fund revolving loan fund, and the MountainLands Revolving Loan Fund.

After Dr. Wayne Brown died unexpectedly in 1988, the organization was renamed as the Wayne Brown Institute® in his honor. It was rebranded as (dba) Kinect Capital in 2023.

Mission

Kinect Capital is a non-profit organization that makes founders more investable and connects them to capital. As our name suggests, we facilitate meaningful connections among entrepreneurs, mentors and sources of capital through a culture of kinship.

For over 40 years, Kinect has made quality networking and pitch events, mentoring and educational programs, and other resources more accessible to overlooked entrepreneurs, including women and minorities.

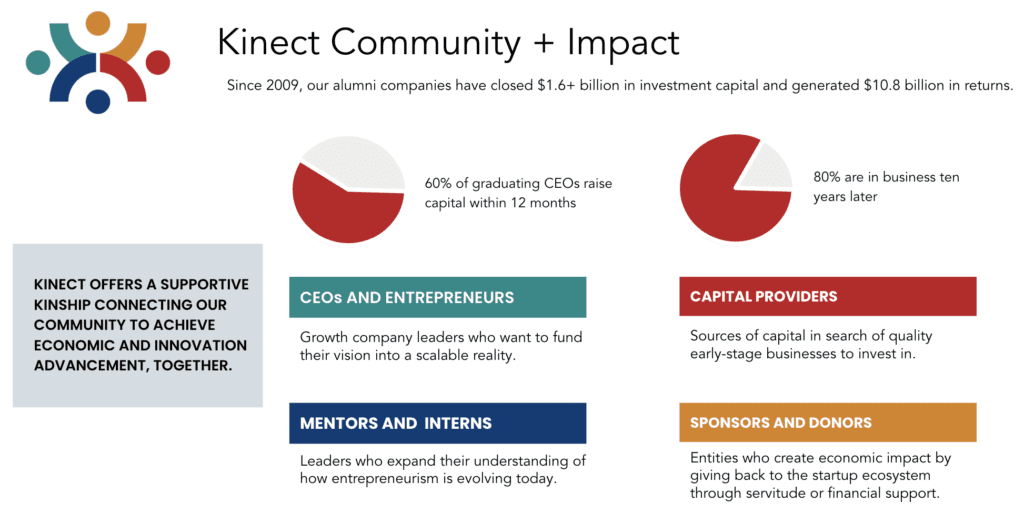

As a result, nearly two-thirds raise capital within twelve months, and 80 percent are in business ten years later, either on their own or through acquisition.

Our vision is to empower emerging and diverse entrepreneurs to create sustainable companies that increase high-quality jobs and new economic opportunities in under-served regions of the US.

Formed in 1983 as an educational 501(c)3 non-profit, Kinect Capital was the first venture accelerator and has become the most efficient, cost-effective economic development organization in the United States.

Results

Kinect Capital continues the legacy begun by Dr. Brown by educating entrepreneurs and company executives through its Cooperative Venturing® program, mentor-based training in the art and science of becoming attractive, viable investment-worthy companies, the essence of commercialization.

To date, Kinect Capital has worked with thousands of entrepreneurs, with over 850 companies participating in the organization’s annual Investors Choice® Capital Conference, the oldest venture capital conference in the U.S.

On average over the last 5 years 60%+ of companies at this event have raise capital by year’s end, and the total has been $40+ million. Since 2009, Kinect Capital alumni companies have realized over $10 billion in investor payouts via M&A Public Offering transactions, including such firms such as Omniture, Sonic Innovations, Myriad Genetics, and Ancestry, and High West Distillery, among others.

Kinect Capital has launched tech commercialization programs in Alabama, Arizona, California, Hawaii, Idaho, Illinois, New York, and Texas. We have mentored startups in 43 states and 3 countries.

Programs & Services

All Kinect Capital programs are designed to assist companies in

1) Shaping themselves into fundable entities

2) Helping them develop a strategy to obtain the funding they need; and when appropriate

3) Providing introductions to the investment and/or banking communities.

Kinect Capital exists to support entrepreneurs who do not have the resources or access to fundamental education about starting and scaling a successful company.