Kinect Essentials: Valuations and Cap Tables

Panel Experts

Chris Badger

Now CFO

Jake Gallagher

VESO

Jeff Erickson

Forecastr

Nick Singleton

AIM Ventura Capital

Angela Smith

Origin Ventures

This Kinect Essentials panel is designed to provide valuable insights about the different valuation methods investors use, how to create and maintain a cap table, and best practices for negotiating with investors.

Valuations and cap tables are essential tools for entrepreneurs fundraising from investors. Valuations are used to determine the worth of a startup or business, while cap tables track the ownership and equity distribution among the company’s investors, founders, and employees.

Meet the Experts

Moderator: Jeff Erickson, Forecastr

Panelists:

Online Resources

BoomStartup Archive: Introduction to Cap Tables with Bert McCooey

An important component to any business formation is the creation of a capitalization table. Cap Table identifies the shareholders and adjusts as the company attains outside capital or incentivizes employees. Watch now.

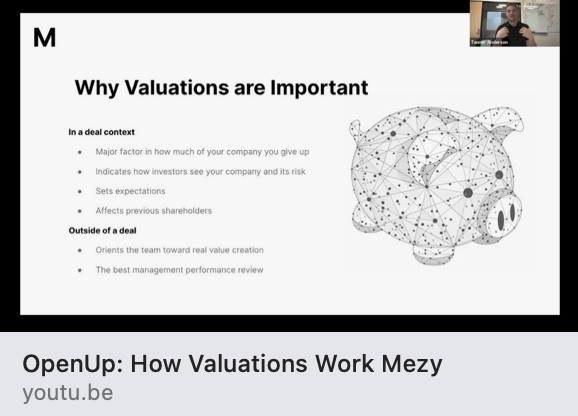

BoomStartup Archive: How Valuations Work with Tanner Anderson

Startups must know how prospective investors place a fiduciary value upon a company, and how valuations affect the investment term sheet. This video goes through the basics of valuations so founders can understand the measurement and approach of valuations. Watch now.

BoomStartup Archive: Interplay Between Cap Table, Valuation, and Financial Planning with Rajesh Gopi

Startups must know how prospective investors place a fiduciary value upon a company, and how those valuations are driven by the company’s financial standings and growth plans. This video walks through the concepts and then goes into how founders can build it out. Watch now.

Capitalization Table Resources for Founders

- Startup Equity Dilution Calculator – Lighter Capital

- Fundraising Benchmarks for Early-Stage Startups – Forecastr

- Equity Compensation Benchmarking Data – Pave

- Founder Studio – Carta

- Startup Resources – Forecastr

- Cap Table Template – Fred Wilson

- Cap tables 101 – capshare

- How to make a cap table – venture hacks

- Captable.io – startup cap table mangagement

- eShares – Cab table management

- Eqvista – Cab table management

- Convertible Notes – Funders Club

- CapTable.io – set up your companies cap table

- Awesome Valuation/Equity Calculator – OwnYourVenture

- TrueEquity – Cab table management

- How VC’s Calculate Valuation – Mark Suster

Forecastr Special Offer Available Through Kinect Capital

- 20% OFF first-year

- Waived $500 Implementation Fee

- White-glove onboarding where we work with you to build a world-class, custom financial model for your company

- Dedicated financial analyst support

- FREE listing on Forecastr’s INVESTOR CONNECT platform ($500 value)

Why Our Customers Love Forecastr

- Custom financial model built in Forecastr

- Dedicated financial expert assigned to every customer

- Ability to easily understand, present and maintain your financial model

- Expert guidance and support to prepare you for investors

- Guardrails that prevent you from ‘breaking’ the financial model and accidentally using misinformation

- Confidence in accurate up-to-date data from direct integrations to your other business solutions (QBO, Gusto, Stripe, etc.)

- Quarterly investor reports and Board presentation slides

- Forecastr’s INVESTOR CONNECT: Exposure to 160+ active early-stage investors